Paradigm Weekly 91: Trading the Noise. Not Falling for It

Shifters,

This week started like a fully loaded clip. One of those macro sequences where the market gods throw everything at us: central bank speeches, PMIs, inflation prints, labor data, and just to spice it up, an OPEC wildcard. All packed into a few days, all with potential to flip sentiment on its head.

We came in saying: “watch your levels and stay on your toes,” and that aged well. Because this week did deliver. Not in screaming volatility, but in the kind of quiet structural shifts that set the tone for the next few legs.

Now that we’ve seen the prints (solid job numbers, sticky inflation, and still no rate cut) the noise vs signal divide is clearer than ever.

Let’s walk through what played out, what mattered, and what setups might be hiding in plain sight.

USDCHF

- Still one of the cleanest trades of the quarter -

We’ve been riding this short from mid-May, and if you were in the Paradigm AMAs or Discord, you already know the structure was textbook. The deviations inside the supply zone weren’t just noise, they were signals. Precise, repeatable, actionable.

Since then? The pair rolled over exactly as expected. Two perfect 1:2 Risk:Reward entries, both hit target. The second one just closed last week: no heat, no stress, no guesswork.

These weren’t trades thrown out in hindsight. They were fully explained beforehand, from reasoning to risk control, with clear invalidation. And this setup didn’t need 20 indicators or hype, just clean structure, context, and discipline.

But here’s the real story:

While some were chasing dopamine plays on social media, shouting about imaginary altseasons and “inevitable reversals,” we just stayed focused on what works (Quietly & Repeatedly)

It’s not always sexy. It doesn’t farm likes. But it builds accounts, and more importantly, it builds traders who know what they’re doing.

If you’re trading your own capital or grinding through prop firm challenges (especially now with how strict the rules are becoming), this is the environment you need.

US Labor Market

Here we go again.

Another Non-Farm Payrolls print, another set of headlines claiming it’s all “unexpected.” But for anyone actually tracking the real data, not the ADP noise or Twitter fear bait: this isn’t a surprise. It’s just confirmation.

Here’s what we got on July 3rd:

NFP: 147K actual vs 111K forecast ✅

Unemployment Rate: 4.1% vs 4.3% forecast ✅

Unemployment Claims: 233K vs 240K forecast ✅

Average Hourly Earnings: 0.3% m/m (still showing wage stability)

Let’s translate that:

Despite the ADP “shock” earlier in the week (-33K), the real jobs data came in solid across the board. Employment is still expanding, wage growth is soft-landing gently, and jobless claims are under control.

That’s not what a recession looks like, not even close.

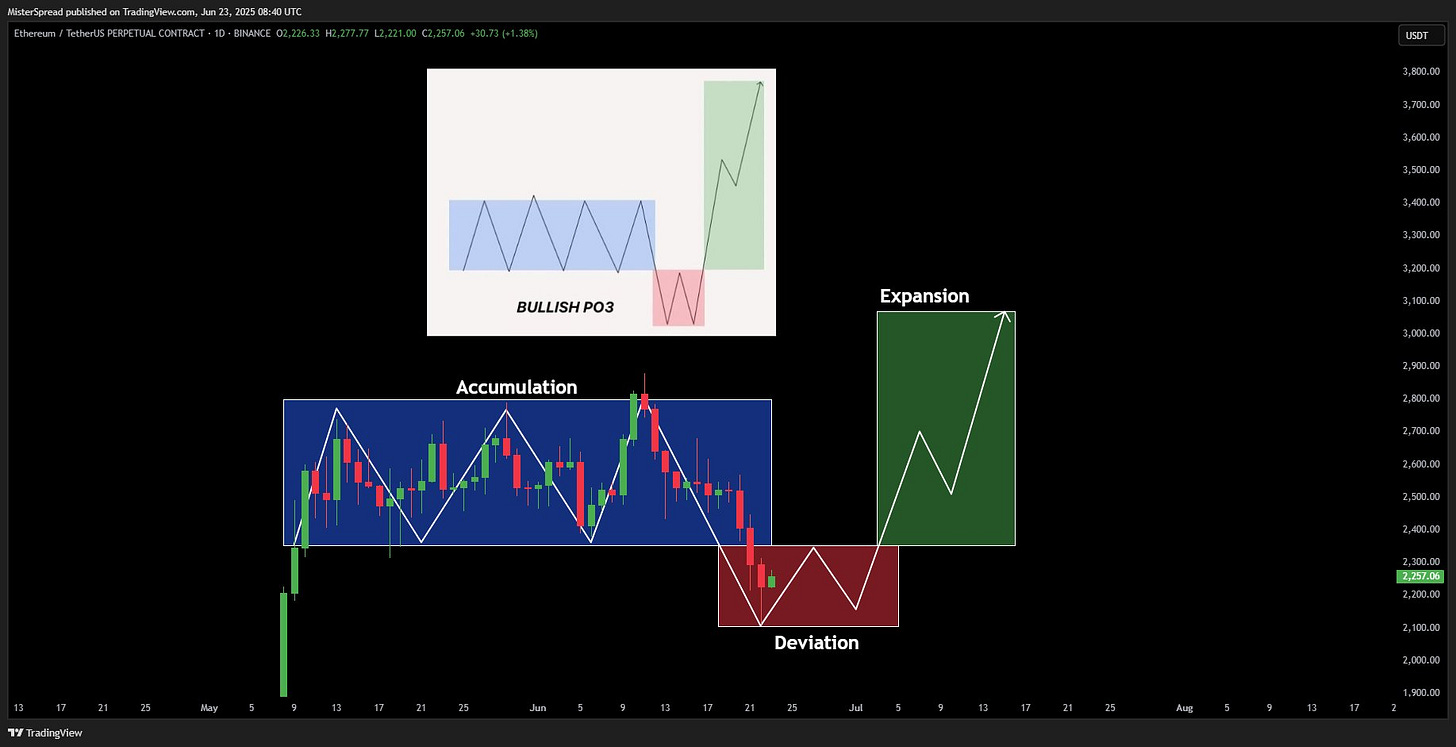

ETH

Let’s rewind to last week, June 24th.

While the timeline was full of FUD, geopolitical panic, and noise, we stayed focused. Price Action was showing signs of strength, not fear. More specifically: I highlighted a potential Bullish PO3 forming on ETHUSDT.

Fast forward, ETH is trading around $2,500, holding structure, showing strength, and pushing deeper into the expansion phase.

We’re not at $2,800 yet, but the move’s unfolding as mapped. Strong ETF inflows this week and a fresh Golden Cross on the daily chart only add weight to the bullish case.

Fading setups like this isn’t just risky: it’s ignoring clear signals.

Imagine fading ParadigmShift 👀

Conclusion

Another week, another masterclass in misdirection from the headlines.

This is why we stay focused. This is why frameworks matter. Not for calling tops or bottoms, but for navigating the in-between the zone where most get chopped up chasing noise and second-guessing every candle.

In ParadigmShift, we don’t chase. We prepare. We zoom out when the feed zooms in. And we build conviction when others fumble with narratives.

Next week? More data, more setups, more chances to execute with clarity. You already know where to be. Let’s keep trading with intent.

DISCLAIMER:

The opinions expressed in this report reflect the author's views as of the publication date and are subject to change without notice. While the author strives to ensure the accuracy of the information, data, and charts presented, accuracy cannot be guaranteed.

The investment perspectives, security analysis, risk tolerance, and time frames discussed are solely those of the author and are not to be taken as financial advice. Consequently, the market views presented in this report should be considered informational only and not as investment advice. Any mention or analysis of specific securities is not an endorsement or recommendation to buy, sell, or hold those securities.

Investors are responsible for conducting their own due diligence and understanding the risks associated with the information reviewed. The content of this report does not constitute and should not be interpreted as a solicitation for advisory services. It is recommended to consult with a registered financial advisor or certified financial planner before making any investment decisions.