Paradigm Weekly 92: Edge Over Emotion (DXY, ETH, BTC)

Shifters,

This past week felt like the market finally took a breath… then sprinted.

Legacy indices pushed higher again, with tech still leading and no real signs of stress under the hood. The dollar bounced early in the week but gave back gains, while commodities and rates stayed mostly range-bound.

In crypto, BTC’s structure stayed intact and kept pressing toward the ATH zone. It’s not there yet, but the price action shows clear intent. If this keeps up, we’re one strong daily close away from re-entering price discovery.

ETH finally started catching some momentum of its own, reclaiming key levels and building a more constructive setup. Rotation is real, and the ETHBTC chart is starting to reflect that shift, slowly but clearly.

This week’s edition starts with a deeper look at trading frameworks and why edge isn’t about catching the wild moves. It’s about knowing when not to swing, and why structure always beats sentiment.

Let’s dive in.

Two traders. Two different lenses. Same market.

Today I had a solid exchange with Sonny on trading approaches. Thought it was worth sharing here because it highlights something many miss: not all strategies are built on the same assumptions, and that’s okay.

What we’re really looking at here is a classic case of framework vs framework.

He’s operating reflexively, tactically, adjusting fast. I respect that.

I just play a different game, one built on confirmation, repeatability, and probability over hype.

Here’s my view:

Longing in a high-timeframe downtrend is fighting both math and structure. That’s a -EV trade, and that was (and still is) my point. It’s not about catching the one move that flies, it’s about what happens when you run that same trade 1,000 times.

Across that sample, shorts win more. Maybe it’s 51% vs 49%, but that’s the edge. That’s what compounds. That’s what creates consistency. People remember the hero trades, the ones that moon. But that’s anecdote, not edge. Real edge lives in structure. In setups. In alignment.

And if I get stopped out? Doesn’t mean it was a bad trade. A good trade can lose. A bad one can win. The outcome isn’t the judge, the process is.

Bottom line: we both respect the market. We just read it differently. And as always, price will settle it.

P.S. If DXY reclaims 101, I’ll flip neutral. Until then, I’m fading the bounces. Nothing has changed.

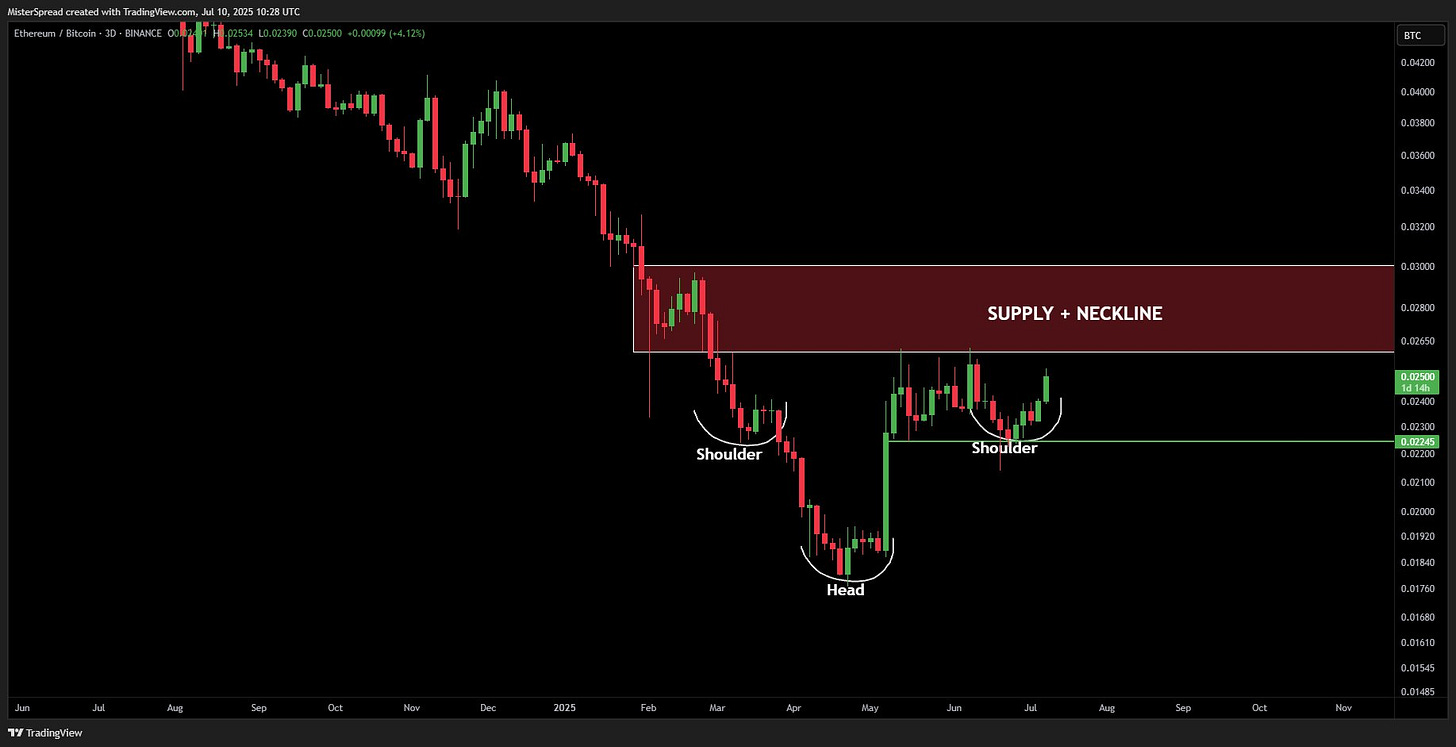

ETH

Back on May 1st, I laid out a framework for early bottoming signs on ETH, with a clear confirmation level at $2,145. I wasn’t trying to catch a knife, I was waiting for the structure to flip and the signals to align. No guesswork. Just execution.

→ Here’s the full breakdown for those who missed it

At that time, ETH was still grinding under $1,860, with liquidity grabs and hesitation all over the chart. But the conditions were there. Ichimoku was starting to shift. Structure was holding. Buyers were stepping in.

Fast forward one week and ETHUSDT rallied over 50%, pushing straight through resistance and reclaiming the key $2,145 level with conviction.

Now, the setup might be evolving again, this time in ETHBTC. We’re starting to see a fresh bottoming formation vs BTC, which could mark the beginning of a rotation phase. Same principles apply: structure first, narrative second. Keep your eyes on it.

If you followed the May playbook, you know the edge wasn’t in timing the low. It was in waiting for confirmation and letting the market do the work.

DXY Multi-Year Bear Market Soon?

What are the odds and implications?

Four months ago, when the Dollar Index ($DXY) was hovering around the 105 area, I wrote an analysis titled: How Trump’s Tariff Strategy is Weakening the Dollar. Since then, DXY has dropped exactly as expected.

Today, we’ll walk through the updated macro framework, what’s changed, and where this trend could be headed next.

First: Let’s Get This Straight

This is not the end of the Dollar.

Ignore the loudest voices screaming collapse and meltdown. This isn’t one of those emotional doom pitches. What follows is a structured take, part technical, part fundamental, on some serious macro shifts I’ve been tracking since last month.

Why EUR/USD Matters

To better understand the potential implications of what I am about to show you, and why this EURUSD monthly chart matters, here is DXY's (Dollar Index) composition. EURO has 57.60% weight out of the DXY basket, so this shit can be more than significant.

17 Years in the Making

EURUSD just broke out of a massive 6,285-day falling channel on the 1M chart. We're now back above 1.1680, a level that's been rejecting price for years. This is not just noise. With this reclaim, bulls are eyeing 1.2600 next.

This is a rare 17-year breakout, and such shifts typically spark multi-year trends. With Fed dovishness and EU macro strength or USD weakness via tariffs and deficits, EURUSD’s bull run could extend well into 2027–2030.

Trump Fractal 2025: Back in Action?

DXY? Let’s just say the Trump Fractal is back. The structure’s cracking. 97 is on deck and if the fractal holds, we could see 94.5 before long.

Flashback to January 2017: Trump steps in, DXY tops, then dumps. Fast forward to now >2025, same President, eerily similar price action. 105.3 broke, 101.3 gone, now we’re dancing around 97.7. If the playbook repeats, 94.5 isn’t just a target, it’s a magnet.

Powell Under Pressure

Trump sent Powell a handwritten note asking for aggressive cuts think 0.5% rates. Powell didn’t blink. He blamed tariff-driven inflation and data fog Markets got the message: no rush to cut. Rate bets now pushed deep into H2 2025.

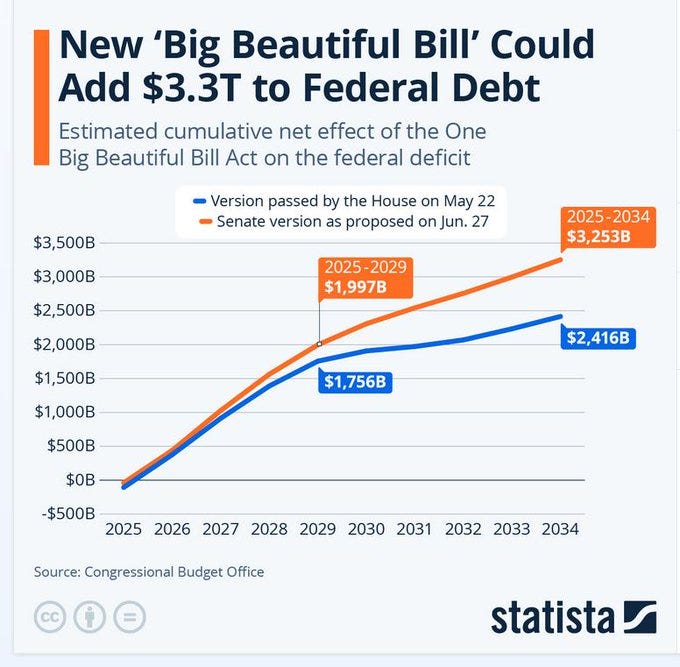

Big Beautiful Bill Landed

Congress approved Trump’s prized “big beautiful” bill locking in the 2017 tax cuts permanently. It also ramps up small business perks, R&D incentives, and deregulation. This is Bessent’s formula: fiscal firepower + rollback. Call it “Bessonomics.”

Scott Bessent isn’t waiting for Powell. He’s pulling Treasury levers hard: a. Short-term debt ramp – T-bills over long bonds. Short duration = more supply sensitivity.

SLR wiggle room: Loosening leverage rules so banks can hoard Treasuries. Each 1pp tweak = 10–50bps off yields.

Tariff tax pivot: Redirecting \$300B–\$600B in tariff revenues toward deficit coverage and middle-class tax cuts.

Market Implications:

Bessent’s tools are doing the easing job through the backdoor.

USD trend: Structurally weak. Tariffs + tax stimulus + SLR = heavy supply, less demand.

EU path: Breakout confirmed. Next target? 1.21–1.22. Then 1.26.

Broader Market

Risk assets: This is fuel. Tax breaks, deregulation & Treasury tools = soft easing. The risk rally has legs.

Markets are forward-looking, maybe that’s why we saw and still see $IWM flying. So watch $SPX & $BTC going forward + altcoins Q3 2025 to Q1 2026.

What to watch

DXY below 95> It’s game over for Dollar bulls.

EURUSD: Clear skies above 1.21, next air pocket at 1.26.

10Y Treasury: A drop under 4.2% and you’ll hear dollar bulls scream.

Watch for SLR tweaks & tariff escalations (August).

This isn’t QE. It’s Treasury-level easing. Fiscal punch + regulatory grease + tariff smokescreens. Powell’s tied up. Bessent isn’t. That’s the difference. They’re engineering USD weakness while claiming it’s all just policy “realignment.” Don’t blink, this is coordinated.

Soo…are we witnessing the start of a multi-year USD unwind?

Markets are pushing higher, crypto’s gaining strength, and DXY’s slipping. The signals are there, structure matters, noise doesn’t.

See you next week!

DISCLAIMER:

The opinions expressed in this report reflect the author's views as of the publication date and are subject to change without notice. While the author strives to ensure the accuracy of the information, data, and charts presented, accuracy cannot be guaranteed.

The investment perspectives, security analysis, risk tolerance, and time frames discussed are solely those of the author and are not to be taken as financial advice. Consequently, the market views presented in this report should be considered informational only and not as investment advice. Any mention or analysis of specific securities is not an endorsement or recommendation to buy, sell, or hold those securities.

Investors are responsible for conducting their own due diligence and understanding the risks associated with the information reviewed. The content of this report does not constitute and should not be interpreted as a solicitation for advisory services. It is recommended to consult with a registered financial advisor or certified financial planner before making any investment decisions.